When you ask a question like, “What will Tesla stock be worth in 2025,” The first thing many investors will tell you is that the Tesla stock price in 2025 could be higher than in 2024.

So, if you’re looking to invest in Tesla stock, you have made a wise decision. However, the earlier, the better. If you had invested $10,000 in Tesla stocks ten years ago, your investment would have been worth $21 million today.

Tesla is currently the biggest EV maker in the world and is valued at over $670 billion. Its near perfection in mass-producing electric vehicles at affordable prices is the reason for its ascension.

Here, we will discuss Tesla’s stock price in 2025 and other details about Tesla to help you make informed decisions. Read on!

What Will Tesla Stock Be Worth in 2025?

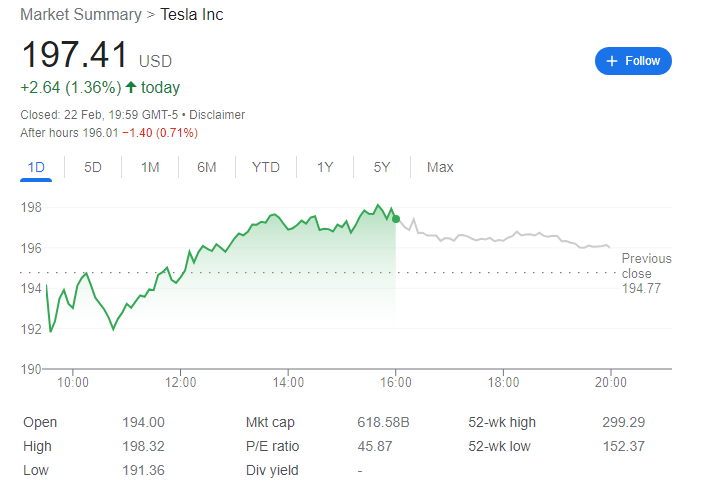

This report was written on February 23, 2024. You can see that Tesla’s stock price at the time of writing was $197.41.

In 2025, Tesla’s stock price will be worth over $234.33. Note also that this forecast is based on the Tesla stock (TSLA) average growth over the past ten years.

The Tesla Stock Price Predictions From Experts

Different experts have made their Tesla stock price predictions. They are all predictions, so we expect them to be less than 100% accurate.

But one thing is clear about these Tesla stock price predictions. From all the predictions, it was obvious that the company’s stock price is expected to grow in the coming years, as it has done over the last ten years.

Predictions from experts like Gov Capital and TradersUnion showed that the EV maker’s stock price will increase, suggesting it could be a wise investment for investors.

But before you invest in the Tesla stock, we would like you to read this content from start to finish.

- Gov Capital’s prediction for Tesla stock shows upward potential for the stock price. They used Tesla stock’s past performances, price trends, and analyst predictions to derive the price of the stock. Gov Capital predicts that Tesla’s stock price will be around $496 by the end of 2025.

A Handy Tip: GOV Capital is standing its ground. It claims TSLA will remain bullish throughout 2025. The reason is the massive opportunity in the electric vehicle market. But understand that there could be some risks that could impact the gains.

We’ll be making a biased prediction if we don’t acknowledge the risks. So, it was reasonable for Gov Capital to acknowledge that risks could wipe out the gains.

- TradersUnion is also predicting a bullish outlook for Tesla stock through 2025. They are looking at $364 per Tesla share by the end of 2025.

A Handy Tip: TradersUnion was also bullish for the Tesla stock price 2022. In January 2022, they predicted $1500, whereas the stock price was $123. So, they overestimated the price.

Some risks come with stock investments naturally, and the TSLA is no exception. But despite these risks, TradersUnion still considers the Tesla stock an excellent long-term investment, citing the massive opportunities in the EV industry.

Tesla’s Brief History

There’s no denying that General Motors, Toyota, and other legacy auto manufacturers are choking on Tesla’s dust. Elon Musk is gradually disrupting the automobile industry.

Tesla has only been around for a few years. It was established in 2003, and Elon Musk only became the CEO in 2008. The EV company IPO in 2010, and the rest has been history.

In contrast, General Motors was founded in 1908.

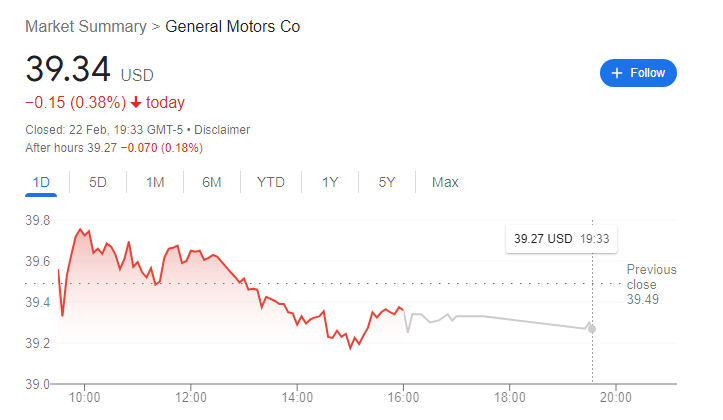

Now, look at General Motors share price. It’s $39.34 as of February 23, 2024. But Tesla’s stock was $197.41 and even recorded some gains. Unfortunately, the reverse was the case for General Motors.

There is hope for General Motors, as the company plans to invest handsomely in EV and AV product development. They plan to invest $35 billion from 2020 to 2025. They could place themselves ahead of some EV makers.

But as things stand, Elon Musk’s Tesla has left the rest of EV makers behind. They are still rivals, but the visionary EV brand always has something up its sleeves, which the other automakers lack.

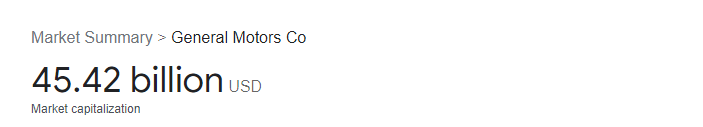

As of February 23, 2024, Tesla had a market cap of $618.58 billion. So, the company is heading towards becoming a trillion-dollar company.

In contrast, General Motors market capitalization is $45.42 billion.

So, you can see clearly that Elon Musk’s Tesla is an EV company on a mission. It is an electric vehicle company with huge potential.

Elon Musk shocked his fellow EV makers and the business community in 2020 during COVID-19. Many claimed Tesla’s production goal was too good to be true, but Elon Musk achieved it.

Production increased by 71%, and over 500,000 electric vehicles were produced. Unlike most EV makers, Tesla isn’t considering introducing flashy new prototypes into the market.

The company’s primary focus at this point is to improve the fundamentals. It wants to deliver fully self-driving vehicles, an achievement that would help the company accelerate past its competitors.

Elon Musk wants to make Tesla the number one EV automaker in the world. He wants Tesla vehicles to dominate the roads.

With vast untapped market opportunities, Tesla is only heading to the top. The innovative EV maker has turned many skeptics into firm believers. It has shown the world that the impossible is nothing.

Tesla’s strong will to succeed, including its innovativeness and untapped markets, make it a wise long-term investment.

What Growth Opportunities Does Tesla Have?

As an investor, there are several reasons to feel optimistic about Tesla stock. The growth opportunities that Tesla has yet to tap into are more than the ones it has. It is yet to expand to some parts of the world.

The world is also speaking one language in the fight against climate change. Soon, vehicles using fossil fuel will be phased out. We will have the option to purchase electric vehicles.

So, without much ado, check out some exciting growth opportunities for Tesla.

1: Tesla can expand into new markets:

The United States of America is Tesla’s biggest market, followed by China and Europe. But these are not the only countries or continents. There is Africa, India, and Latin America.

So, there are plenty of untapped markets for Tesla vehicles, and the company is undoubtedly looking into these opportunities. It will consider expanding to these regions in the future.

Tesla will look to expand to markets like Africa, India, Southeast Asia, and Latin America. And with the financial capacity and innovator, in the person of Elon Musk, in the company’s driver’s seat, the goal is achievable.

2: In-house battery manufacturing:

Tesla’s ability to produce its battery pack and some of the cells it uses is a massive positive for the company. It gives the company an upper hand to improve performance and reduce costs.

3: Build affordable EVs for the people:

One primary reason many people don’t yet have a Tesla or an EV in their garage is the price of electric vehicles. Unfortunately, most EV makers complain of the high cost of production.

An EV battery replacement costs around $4,000 to $20,000. Excitingly, Tesla is working on producing affordable EVs. It wants its EVs to populate the roads in every country.

Since Tesla produces the batteries, some cells, and other essential parts, lowering the prices won’t be an issue. The company will still make a profit. Sales of parts are another avenue for the company to make more profit.

So, the fact that Tesla is looking into building more affordable EVs is enough evidence to convince anyone that its stocks are worth splashing the cash on. The company wants to produce budget electric vehicles for around $25,000. That’s quite impressive.

4: Introducing new models into the EV market:

Introducing new models into the EV market will drive sales. It will give people more options, which is a great marketing strategy.

Introducing new EVs is a vital strategy to stay relevant and draw attention to the company. Tesla and Elon Musk know this. That is why they are working hard to produce the Cyber Truck and Semi. He wants to diversify Tesla’s offerings and access a different section of customers.

5: Exploring the air-taxi market:

If you think Elon Musk and Tesla would stop at EV manufacturing, you better have a rethink. Tesla is considering the possibility of entering the electric vertical take-off and landing vehicle market.

The eVTOL (Electric vertical take-off and landing) vehicle will be the world’s primary focus in a few years. And Tesla has indicated interest in being a player in that growth.

How To Purchase Tesla Stock

Tesla is currently one of the world’s most valuable automakers. Its stock performance has also been an exception for the past decade.

Tesla is traded on the NASDAQ stock exchange as “TSLA.” Unfortunately, there is no direct stock purchase option for buyers. If you want to purchase Tesla stock, you have to use a broker.

There are diverse ways to make a profit off Tesla stock. Most people buy and short-sell. Depending on the performance, you can do the same to your Tesla stock. Another way to profit from Tesla stock is to keep them long-term.

Now, let’s discuss how to purchase a Tesla stock. But first, do you have a broker account? If you don’t, you can open one right away.

Here is how to acquire Tesla stock.

1: Go through a brokerage:

You can purchase TSLA via your brokerage account. And you can buy via three options. The first is the market. You can purchase Tesla stock at market price. The benefit of this option is that you can hold the stock until you are comfortable selling it. You can hold them indefinitely.

Another option is “a call.” But note that you can’t keep the stock indefinitely when you buy through this option. In other words, stocks purchased via a call option are only tradeable for a limited period.

When you purchase stock via a call option, you want the price to increase before selling.

There’s another option called “a put” option. If you purchase Tesla stock via a put option, you would want the stock value to decrease before selling.

2: Decide your strike price:

Your strike price entails the amount you’re willing to spend on a Tesla stock. In other words, it refers to how much you will pay for the stock at a premium.

If the stock price is currently $670, you can set your strike price at $660 to purchase a put option.

3: Decide your expiration date:

Stocks purchased via a call or put option have expiration dates. And once the expiration date passes, the stocks become invalid. In other words, you can no longer sell them.

Only stock purchases at market price are indefinite. You can hold and sell them at any time.

You can set the expiration date of stocks purchased via a call or put the option to a week or several years. But note that the longer you keep these stocks, the more premium you’ll pay.

4: Decide the number of contracts you would like to have:

If you purchased your stock via a call or put option, note that there’s a contract for every 100 shares of stock. So, the number of contracts you’ll eventually purchase depends on you as an individual.

You’ll have to consider several factors to decide the number of contracts you will eventually get. The two significant factors include the company’s prospects. You can acquire more contracts if you feel the company has a promising future and great potential.

Another factor you need to consider is your budget. How much will you spend to acquire the number of contracts you’re hoping for?

5: Keep monitoring the stock prices:

Investors are famous for doing one thing: they are always busy monitoring the prices of stocks they acquire. You’ll know the best action to take if you can monitor your stock prices.

Most people think Tesla is overvalued. They claim the bull case for Tesla came to be because Elon Musk is being painted as a genius, while EVs are considered the future of transportation.

There might be some element of truth in these ascertains. Tesla might be overvalued. But when you purchase Tesla stocks and keep them for a period, chances are you’ll make a profit.

Many fear that another EV maker might spring up and overtake Tesla. But while this is possible, we should remember that Tesla didn’t get to where it is overnight. It has been in the industry for over a decade and has paid its dues.

Many people might not like Elon Musk, and he has no issue with it. But we cannot deny that the Tesla boss is a genius.

A Handy Tip: According to NASDAQ, Tesla stock’s 12-month average price is $455. Its highest price within this period is $788, while the lowest recorded is $60.

As an investor, you must monitor your Tesla stock as often as possible. By doing so, you’ll understand when to pull out or keep holding your shares.

Another vital advice investors must heed is to invest only money you can lose. Don’t invest money that will plunge your family into poverty when the investment doesn’t yield the expected results.

Factors Capable of Affecting Tesla Stock Worth

Tesla stock prices can sometimes be too good to be true. It will make you feel like you’re in a dream line. Its bullish heights could reach $788, and its bearish low as little as $60.

Different factors drive Tesla stock prices. These include innovative hype around the company, analyst predictions, and Elon Musk’s personality.

A single activity that benefits Tesla or involves it can increase its stock price. For example, a patient can impact the stock price positively. Even a partnership or property can have a similar impact.

Many people are firm believers of Elon Musk. They know how dogged, innovative, and committed Elon Musk can be when working on a mission.

Sector trends and interest rates can also impact Tesla’s stock price. But are these enough to discourage an investor from buying them?

Instead of focusing on the TSLA rollercoaster price, focus on the company’s addressable market and competitive advantage. Tesla has numerous growth opportunities that show its stocks have great potential.

Conclusion

So, what will Tesla stock be worth in 2025? Tesla stock may reach $234.33 in 2025. We are in 2024, and the stock price is already $197.41.

This post isn’t financial advice. But Tesla stocks have been exceptional performance-wise for the last decade.

The electric vehicle maker has massive growth opportunities. It wants to start making affordable EVs that cost $25,000.

In addition, Tesla hasn’t penetrated several markets yet. The United States of America is the company’s biggest market, followed by China and Europe. Southeast Asia, Africa, and other regions still need to be tapped. So, there is a massive growth opportunity for the EV maker.